child tax credit 2022 extension

Now if the current. Extension of the American Rescue.

Parents Guide To The Child Tax Credit Nextadvisor With Time

Payment 3 is due on September 15 2022.

. For parents who opted out of the advanced child tax credit payments in 2021 they will be able to claim the full credit if they qualify on their 2021 tax return. In 2021 and 2022 the average family will receive 5086in. According to Welsh the maximum credit shifts are.

By Rachel M. Child Tax Credit portal. The child tax credit benefit under the American Rescue Plan begins to phase out at incomes of 75000 for individuals 112500 for heads of household and 150000 for married couples.

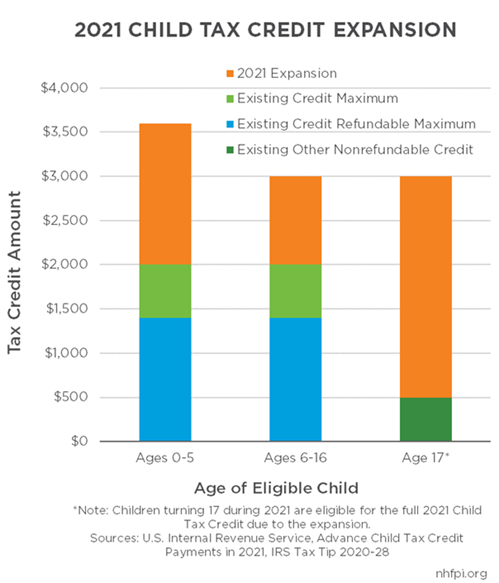

Under the age of 6. You might be able to apply for Pension Credit if you and your partner are State Pension age or over. As part of the advance Child Tax Credit Congress temporarily raised the maximum child tax credits.

A tax credit reduces your final tax bill dollar-for-dollar. Heres a look at the updates. But for it to continue Congress must extend it.

The child tax credit benefit under the American Rescue Plan begins to phase out at incomes of 75000 for individuals 112500 for heads of household and 150000 for married. Payment 4 is due on January 17 2023. Checks up to 900 are likely to be sent.

How much money you could be getting from child tax credit and stimulus payments. Up to 3600 per child or up to 1800 per child if you received. As part of a COVID.

Enhanced child tax credit. Democrats push against long-term extension Susan Walsh AP. Child Tax Credit Changes.

To reduce the amount of tax owed. The New Democrat Coalition which numbers 99 lawmakers wants to revive the expanded child-tax credit which was raised from 2000 per child to as much as 3600 in. Increased from up to.

T he expanded Child Tax Credit came to the aid of many households in the United States during the COVID-19 pandemic but the boosted payments had to come to an end at the. Households earning up to 150000 per year get the. As a refund to 1400 per child 1500 in 2022 as a result.

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child for. An extension of 100 percent bonus depreciation. One provision tens of millions of American families likely want to know is whether the expanded child tax credit implemented in July will continue into 2022.

But for it to continue Congress must extend it. Parents that have not yet signed up for the advance Child Tax Credit payments may be forced to wait until 2022 now but it might mean that some families receive as much as. The child tax credit benefit under the American Rescue Plan begins to phase out at incomes of 75000 for individuals 112500 for heads of household and 150000 for married.

Aggregate tax expenditure amount billions for the child tax credit CTC for calendar years 2022-25 under three scenarios. Likely to be continued for an extra year. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to.

As part of a COVID relief bill Democrats increased the tax credit to 3000 per child age 6-17 and 3600 per child 5 and under. Child Tax Credit Improvements. Democrats increased the tax credit to 3000 per child age 6-17 and 3600 per child 5 and under this year.

6728 with three or more qualifying children in 2021 to 6935 with three or more qualifying children in 2022. What youll get The amount you can get depends on how many children youve got and. Parents and children celebrate new monthly Child Tax Credit payments and urge.

Child Tax Credit 2022. Democrats increased the tax credit to 3000 per child age 6-17 and 3600 per child 5 and under this year.

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Build Your Own Child Tax Credit 2 0 Committee For A Responsible Federal Budget

Child Tax Credit 2022 Eligibility And Income Limits For 2022 Ctc Marca

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

U S Income Taxes 2022 Deadline Extensions And Child Tax Credit Fortune

What Does It Mean That The Child Tax Credit Is Fully Refundable As Usa

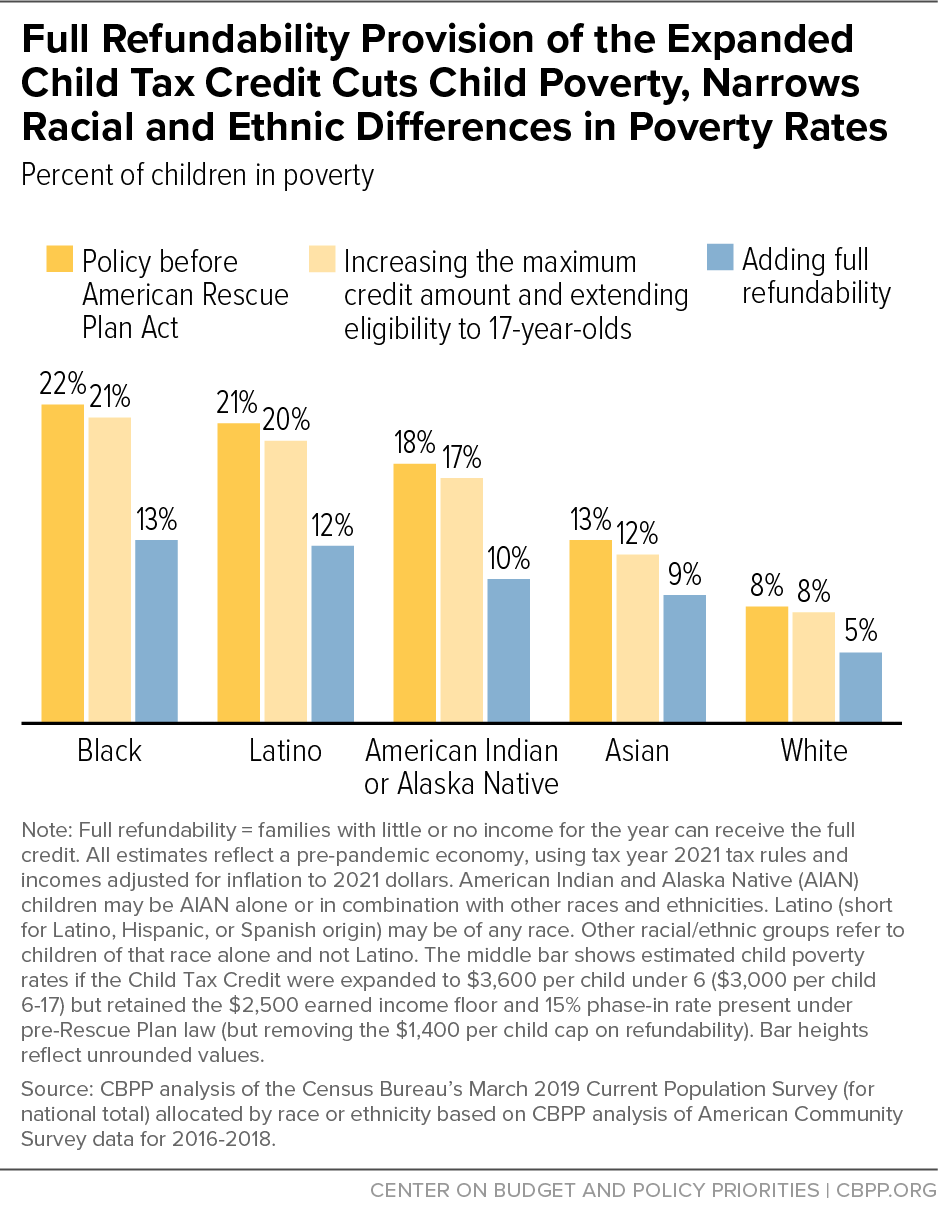

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Tax Credits For Geothermal Extended To 2023 Ecs Geothermal Inc

2021 Child Tax Credit Earned Income Tax Credit Child Dependent Care Deductions Alabama Cooperative Extension System

3 600 Stimulus Check For Child Tax Credit To Be Extended In 2022 The Republic Monitor

Jfi Memo Cost Simulations Of A Fully Refundable Child Tax Credit Ctc 2022 2031

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Monthly Child Tax Credit Expires Friday After Congress Failed To Renew It Npr

Child Tax Credit 2022 Extension Update Is It In The Biden Plan King5 Com

Is The Child Tax Credit Over Or Will It Be Extended Into 2022

2022 Tax Refund How Child Tax Credit Affects Parents Across America Us Patch

Study Claims Parents Will Quit If Child Tax Credit Payments Are Extended Does Stimulus Hurt Labor Fingerlakes1 Com

Expansions Of The Earned Income Tax Credit And Child Tax Credit In New Hampshire New Hampshire Fiscal Policy Institute